1. Logistics – ERP, Finance, Accounting/Billing System

Problem Statement: South West Distribution, the largest distributor of The Washington Post, suffered for years with a legacy accounting system that had too many incomplete workflows that created reporting issues for AR and AP, ad had extensive labor costs. The old system didn’t meet the needs of the business on any level, and wasn’t scalable or easy to use. Labor costs, as well as reporting issues for A/R and A/P were a risk to the business.

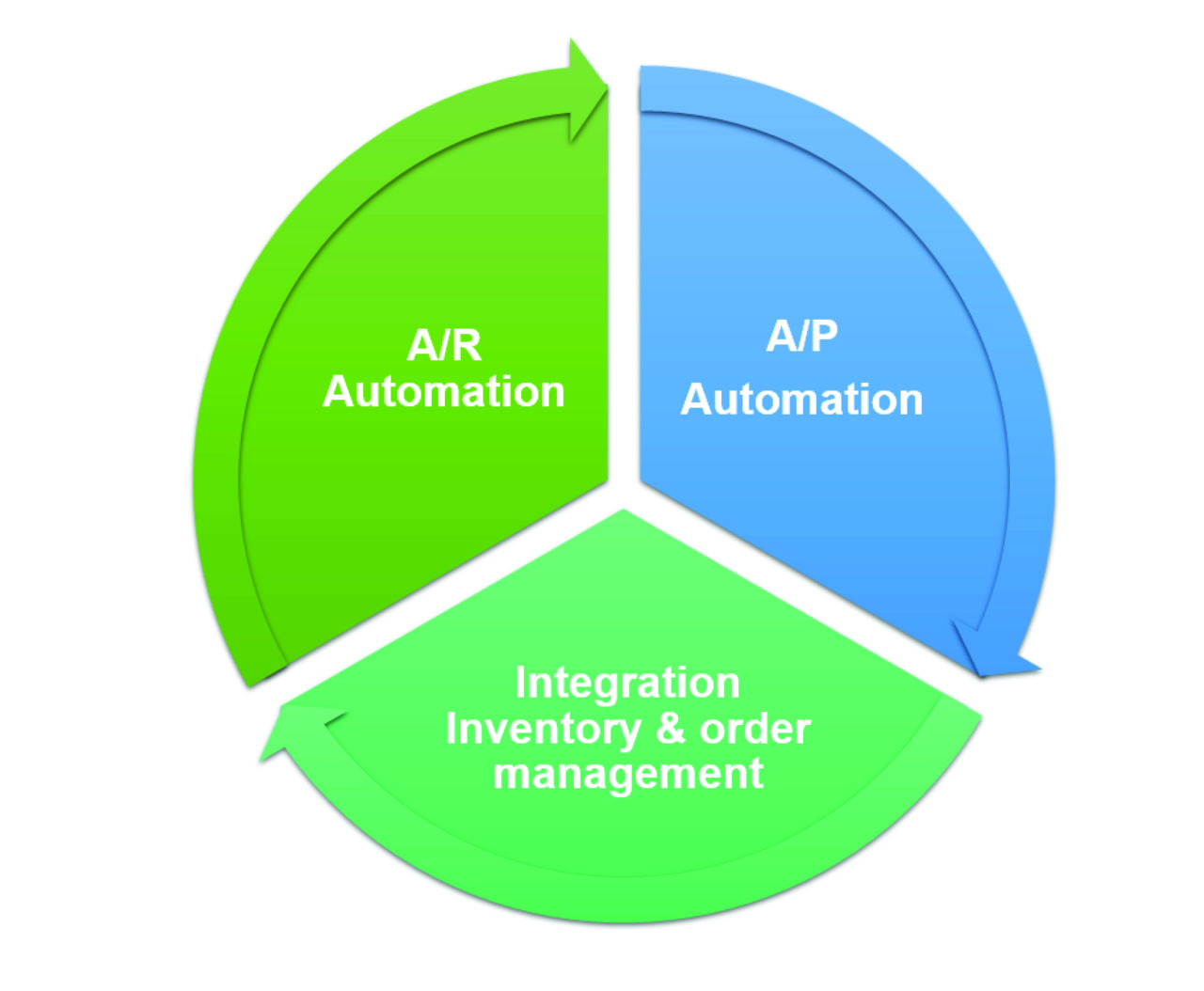

Solution: Assurety re-engineered their software applications with automated workflows and scalable, secure and accessible web-based interfaces with interactive dashboard views that reduced accounting costs and met the needs of the company.

Services from Assurety: Consulting, Integration, Workflow Redesign, Automation, Software Engineering

Technology: Microsoft .Net C#, MS SQL server, web-based reporting

Client: South West Distribution

2. Banking System – Re-Engineering of a B2B Banking and Mortgage system

Problem Statement: MBS (Mortgage Banking System), the oldest financial institution that supports the US mortgage industry, suffered with a legacy banking system that included more than 83 software versions, which made software management and security a costly nightmare. MBS needed a modern, scalable system that could be deployed with minimal interruptions to ongoing business.

Solution: Assurety analyzed the entire legacy accounting system – which included a complex rules engine with more than a thousand banking rules — to land on a workable solution. Assurety considered the UX/UI needs of end users, and redesigned and re-engineered the entire system with a cloud-based solution using Microsoft technology stacks. They also developed a Services Oriented Architecture to simplify communications with seven other partnering solutions to complete the workflows.

Services from Assurety: Workflow Redesign, Software Engineering, Systems Engineering, Integration, Project Management, Communications, Stakeholder Management

Technology: MS .NET C#, Oracle, Web Services, MicroStrategy

Client: MBS

3. Credit Card Fraud – Risk-Based Identification Program Development

Problem Statement: A Bank wanted to develop a risk-based fraud detection platform that could predict and identify fraudulent credit card transactions in real-time.

Solution: Assurety designed and planned a risk-based program office with a team of data scientists, data analysts and software engineers to develop a Python-based solution. The new system included a data warehouse that brought in more than 13 data sources to predict fraudulent transactions. Assurety also developed a machine learning algorithm to look for anomalies and update the algorithm automatically to stay one step ahead of the fraudsters.

Services from Assurety: Workflow Redesign, Software Engineering, Systems Engineering, Integration, Project Management, Decision Support, Fraud Detection, Visualizations, Data Warehouse, Machine Learning

Technology: Oracle, SAS, Python, DataIQ, R, Tableau

Client: A large US-based financial institution.

4. Credit Card Platform Integration – eCommerce Implementation

Problem Statement: USPS sought to switch banking vendors for online credit card transactions accepted through their eCommerce site, Welcome | USPS . With regulatory and internal security rules changes, the new system needed to be more secure and have a separate architecture. Their bank wanted to develop a risk-based fraud detection technology platform that could predict and identify fraudulent credit card transactions.

Solution: Assurety planned and designed a risk-based program office with a team of data scientists and data analysts and software engineers to develop a Python-based solution, developing a new data warehouse and bringing in over thirteen data sources to predict fraudulent transactions. Assurety also developed a machine-learning algorithm to look for anomalies and update the algorithm automatically to add more attributes and rules to the algorithm.

Services from Assurety: Workflow Redesign, Software Engineering, Systems Engineering, Integration, Project Management, Decision Support, Fraud Detection, Visualizations, Data Warehouse, Machine Learning

Technology: IBM WebSphere, Java, Oracle

Client: USPS

5. Online Credit Card Fraud Alerts

Problem Statement: USPS already had Predictive analytics in place and needed an organization to implement machine learning algorithms, train the algorithms with a goal to minimize false positives causing extensive cost as well as customer experience issues.

Solution: Assurety ideated, brought in both financial and cyber experts to work with our data scientists and data analytics to develop the machine learning analytics solution. The overall false positives were cut by 31% in the first year of implementation saving extensive costs to the USPS as well as unnecessary stress and anxieties for Credit card customers.

Services from Assurety: Data governance, data science, fraud and cyber expertise utilizing machine learning technical skills.

Technology: Oracle, Tableau, Python

Client: USPS Retail